Inherited ira rmd calculator 2021

Its equal to 50 percent of the amount you were supposed to withdraw. A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year.

Why Taking Rmds On Time Is So Important J P Morgan Private Bank

Maya inherited an IRA from her mother.

. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. This calculator has been updated to reflect the new. If you want to simply take your.

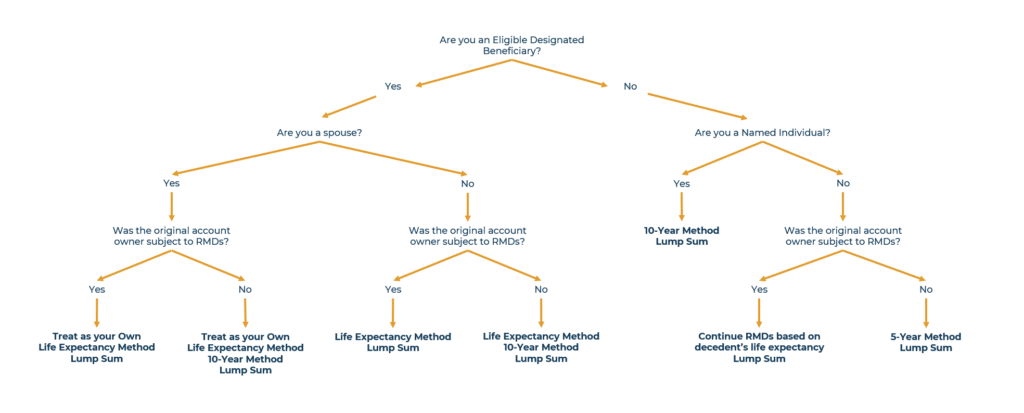

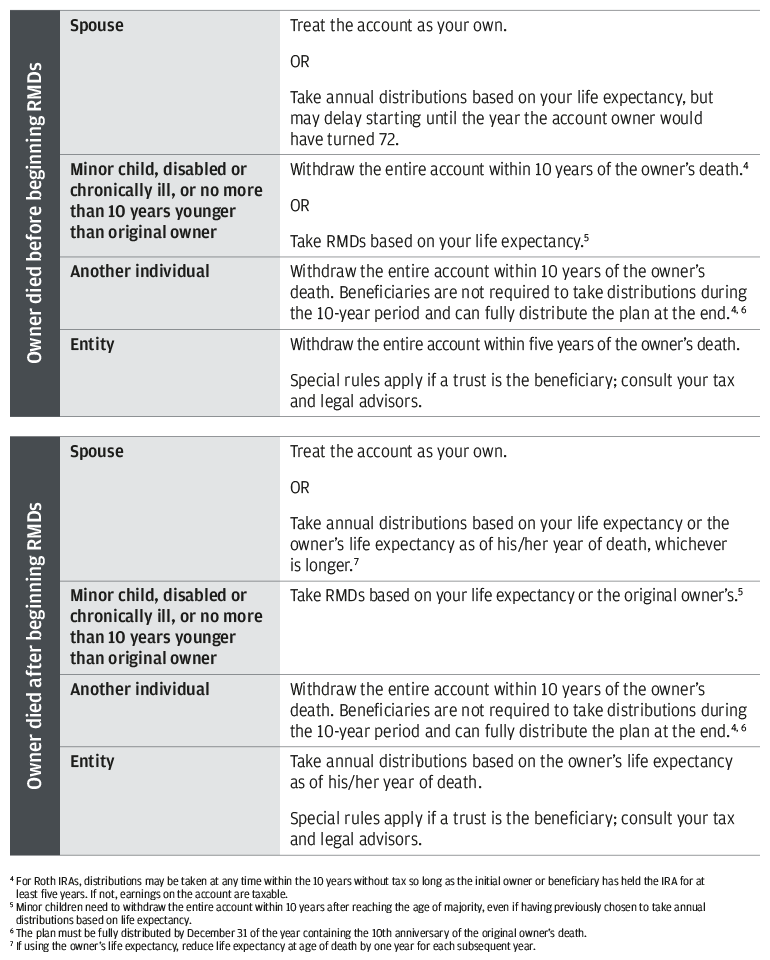

If you inherited an IRA such as a traditional rollover IRA SEP IRA SIMPLE IRA then the rules around RMDs fall into 3 categories. Use younger of 1 beneficiarys age or 2 owners age at birthday in year of death. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year.

If youve inherited an IRA depending on your beneficiary classification you may be required to take annual withdrawalsalso known as required minimum distributions RMDs. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Ad Use This Calculator to Determine Your Required Minimum Distribution.

If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from. Get Up To 600 When Funding A New IRA. Inherited IRA Roth IRA Inherited IRA Rules.

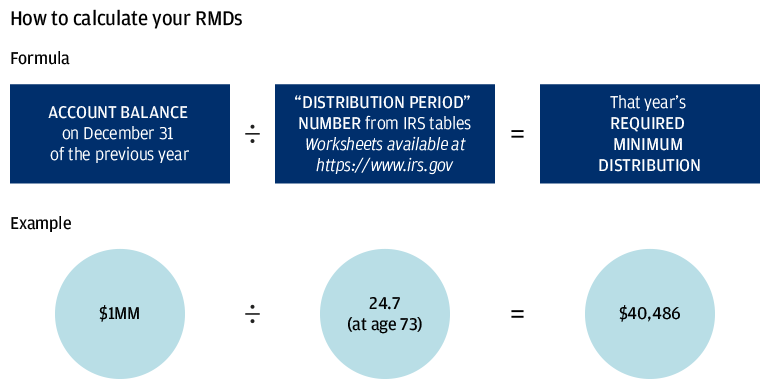

Use this worksheet to figure this years required withdrawal from your non-inherited traditional IRA UNLESS your spouse 1 is the sole beneficiary of your IRA. Determine beneficiarys age at year-end following year of owners. Once the factor is determined it can be divided into the December 31 2020 balance to get the RMD amount for 2021.

The IRS generally requires nonspouse inherited IRA owners to start taking required minimum distributions RMDs no later than December 31 in the year following the death of the. Ad Actionable Investing Ideas and Trends You Can Use to Help Clients Pursue Their Goals. We researched it for you.

Inherited ira rmd calculator 2021 Jumat 02 September 2022 Edit. Rmd Calculator For Inherited Ira Etoro 2021 Online. Ad All You Need To Know About Inherited IRA RMD.

The 10-year rule applies regardless of whether the participant dies before on or after the required beginning date RBDthe age at which they had to begin RMDs. You are retired and your 70th birthday was July 1 2019. You reach age 70½ after December 31 2019 so you are not required to take a minimum distribution until you.

Calculate the required minimum distribution from an inherited IRA. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Find Out What You Need To Know - See for Yourself Now.

RMD amounts depend on various factors such as the decedents age at death the year of death the type of. These amounts are often called required minimum distributions RMDs. Here S How To Calculate Your Required Minimum Distribution From A Traditional Ira Or 401 K The Motley Fool Traditional Ira Required Minimum Distribution The Motley Fool.

36 rows This calculator determines the minimum required distribution known as both RMD or MRD which is really confusing from an inherited IRA based on the IRS single life expectancy. When you are the beneficiary of a retirement plan specific IRS rules regulate the minimum withdrawals you must take. Looking fro Rmd Calculator For Inherited Ira Etoro.

Explore Choices For Your IRA Now. This calculator has been updated for the. Get Up To 600 When Funding A New IRA.

Account balance as of December 31 2021. Use one of these worksheets to calculate your Required Minimum Distribution from your own IRAs including SEP IRAs and SIMPLE IRAs. Calculate your earnings and more.

1 Use FINRAsRequired Minimum Distribution Calculator to calculate your current years RMD. Use this worksheet for 2021. Ad Actionable Investing Ideas and Trends You Can Use to Help Clients Pursue Their Goals.

Learn More About American Funds Objective-Based Approach to Investing. As part of the bipartisan COVID-19 stimulus bill Congress suspended required minimum distributions for 401k and IRA plans for 2020. Ad Explore Your Choices For Your IRA.

How is my RMD calculated. Spouses non-spouses and entities such as trusts estates. Learn More About American Funds Objective-Based Approach to Investing.

EToro is a multi-asset and foreign exchange trading company that specializes in. Ad An Edward Jones Financial Advisor Can Partner Through. Register and Subscribe Now to work on IRS IRA Required Minimum Distribution Worksheet.

Determine the required distributions from an inherited IRA. RMDs are also waived for IRA owners who turned 70 12 in 2019 and were required to take an RMD by April 1 2020 and have not yet done so. Account balance as of December 31 2021.

2022 Retirement RMD Calculator Important. The IRS has published new Life Expectancy figures effective 112022. Distribute using Table I.

Your life expectancy factor is taken from the IRS.

Required Minimum Distributions Rmds Are You Ready

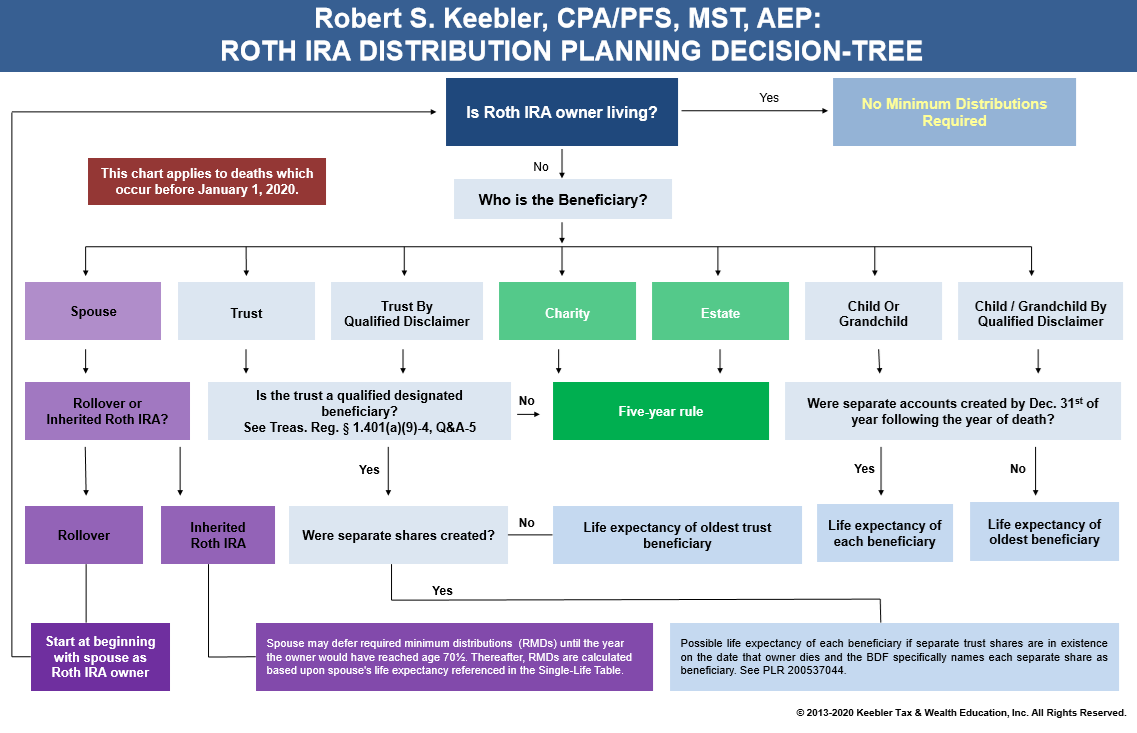

2022 Roth Ira Distribution Chart Ultimate Estate Planner

Required Minimum Distribution Calculator Estimate The Minimum Amount

Required Minimum Distributions American Century Investments

What To Do If You Inherit An Ira Post Secure Act Wealthspire

Why Taking Rmds On Time Is So Important J P Morgan Private Bank

How Do Rmds Work Paul Winkler Inc

Required Minimum Distributions American Century Investments

Required Minimum Distributions American Century Investments

Required Minimum Distributions American Century Investments

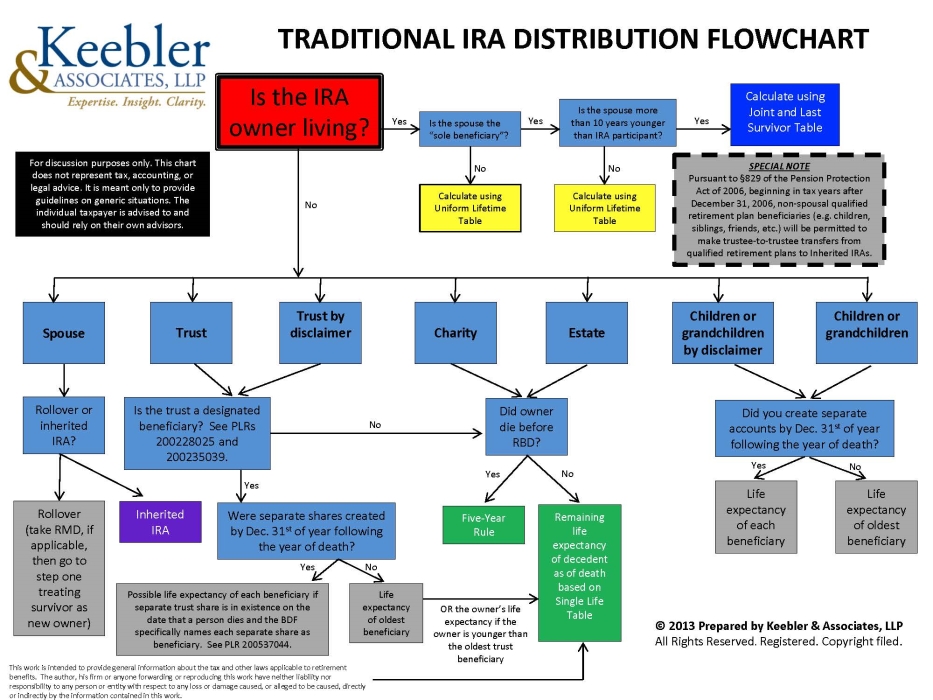

Client Friendly Laminated Charts Ultimate Estate Planner

Required Minimum Distribution Calculator

2

Lincoln Investment Required Minimum Distribution Rmd

Required Minimum Distributions American Century Investments

2

Required Minimum Distributions American Century Investments